Investing in an Election Year – What you Need to know

Every four years, we tend to get the same questions and concerns from our clients regarding the presidential election and how it may impact their investments. With all the media surrounding the election, it is hard for people to discern between fact and opinion. This can make it difficult for investors to maintain perspective, to focus on what they can control, and to keep a long-term view.

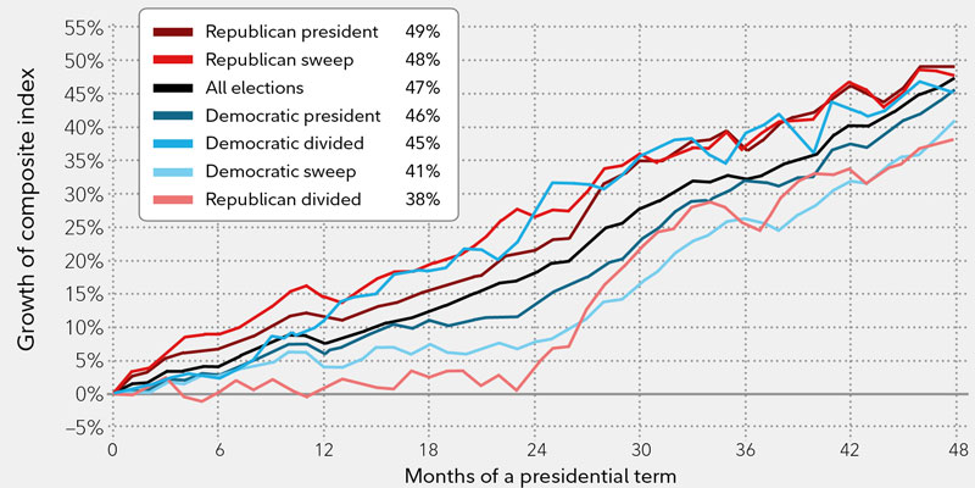

What does history have to say? Fidelity did a study looking at the returns through the eyes of the presidential election cycle. They looked at the return from October preceding a presidential election to 4 years later. Why not just look at when the elected president actually took office? That is because the market is a forward indicator, meaning the returns from the election to the inauguration are in anticipation of the president taking office. We saw this with the 2016 election, where the market was trending lower up until the election in anticipation of a certain result, but then post-election through inauguration the market was up a decent amount. Fidelity also broke the returns down into different outcomes of congressional elections. The results show that while there is a spread in returns depending on the election results during the first 2-years of an administration, by the time the fourth year comes, most of that variance is gone (see the chart below).

While there may be many reasons, and probably even more opinions, on why there is this spread in returns over the first 2-years, the point to focus on is that this spread dissipates over time. While in the short run, the market may react to the sentiment of the elections and political news, over the long run, it will follow the fundamentals of the economy and the companies that make up the market. Some of these fundamentals are earning and cash flows of the companies, interest rates, labor growth, productivity growth, and monetary policy. While certain policies may affect these fundamentals, the parties that implement them do seem to alternate over time, meaning that nothing is permanent.

History shows that you are better off concentrating on what is in your control than worrying about who is in office. That starts with making sure you have a plan and being deliberate with how you are invested. That will prepare you and give you more confidence which will help you make better decisions regarding your investments and your personal financial future.

If you need help making sure your portfolio/investments are prepared for the next two years, please contact our team, and one of our financial planners might be able to help you. Your initial meeting is free of cost and confidential — Call 607-217-5091 to schedule.

S.E.E.D. Planning Group LLC (S.E.E.D.)is a Registered Investment Advisor (RIA) with the Securities Exchange Commission. S.E.E.D.’s team provides investment fiduciary and financial planning services to clients. Our fees are disclosed, easy to understand, and not predicated on product sales.

Investing involves the risk of loss. Past performance does not guarantee future results. The chart depicted is monthly data since 1789 (mix of S&P 500, Dow Jones Industrial Average, & Cowles Commission). Source: Fidelity Viewpoints 1/29/2020 Presidential elections and stock returns.